Understanding Inflation: A Deep Dive into Its Impact on Everyday Living Costs

Inflation is one of those economic terms that gets thrown around frequently, often leaving many people puzzled about its actual meaning and impact. While it seems like a complex economic concept, the truth is that inflation affects every aspect of our daily lives, from the price of groceries to the cost of borrowing money.

What is Inflation?

Inflation refers to the general increase in prices and the corresponding decrease in the purchasing power of money. In simpler terms, when inflation occurs, you need more money to buy the same amount of goods and services compared to a previous time period. This phenomenon is measured by various indices such as the Consumer Price Index (CPI) and the Producer Price Index (PPI).

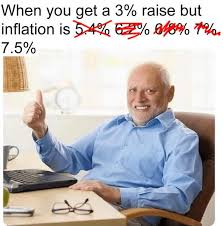

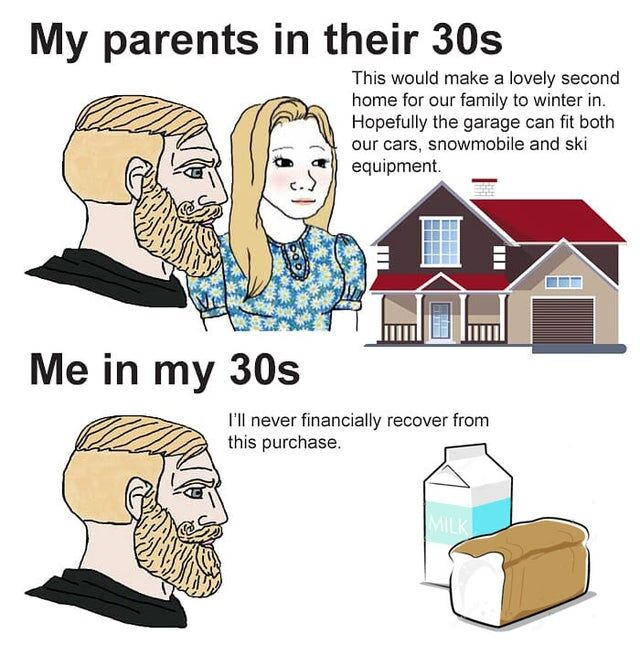

Inflation Memes: A Humorous Take on a Serious Issue

In the digital age, no topic is too serious to escape the creative minds of internet meme creators, and inflation is no exception. These humorous yet poignant images and captions offer a lighthearted perspective on the often grim reality of rising living costs. Let’s explore how inflation memes provide both comic relief and a lens through which to understand public sentiment on this economic issue.

Comic Relief Amid Financial Strain

Inflation memes often feature relatable scenarios that highlight the absurdity of skyrocketing prices. Whether it’s a comparison of grocery bills from a few years ago to today or a joke about the cost of a cup of coffee, these memes resonate because they reflect the everyday experiences of people coping with inflation. By using humor, they provide a moment of levity and a way to laugh at what can otherwise be a stressful situation.

Reflecting Public Sentiment

Beyond the humor, inflation memes also serve as a barometer of public sentiment. They capture and amplify the frustrations and concerns of people facing higher prices. Memes about inflation often go viral because they articulate a shared experience in a way that is easily understandable and widely relatable. This viral nature of memes underscores the widespread impact of inflation and the collective exasperation felt by many.

Simplifying Complex Economic Concepts

Another valuable aspect of inflation memes is their ability to distill complex economic concepts into simple, digestible formats. For instance, a meme might depict a balloon labeled “inflation” being inflated until it pops, visually explaining how excessive inflation can lead to economic instability. Such visual and concise explanations can help demystify economic jargon for the average person, making the concept of inflation more accessible.

Engaging Younger Audiences

Memes are particularly effective at engaging younger audiences who might not typically follow economic news. By packaging important information in a humorous and visually appealing way, inflation memes can raise awareness and spark interest among millennials and Gen Z. This engagement is crucial as these younger demographics will be significantly impacted by economic policies and trends.

In summary, while inflation is a serious issue that affects everyone, memes about inflation provide a unique blend of humor and insight. They offer a way to cope with financial stress, reflect collective frustrations, simplify complex ideas, and engage a broader audience. So, the next time you see an inflation meme, remember that it’s not just a joke – it’s a reflection of the times we live in.

Causes of Inflation

Inflation doesn’t happen in a vacuum; multiple factors contribute to it, including:

- Monetary Policy: Central banks, such as the Federal Reserve in the United States, influence inflation through their control of the money supply. An increase in the money supply usually leads to inflation.

- Demand-Pull Inflation: Occurs when demand for goods and services exceeds their supply, causing prices to increase. An example of this could be a booming economy where consumers have more disposable income.

- Cost-Push Inflation: Results from an increase in the cost of production. When companies face higher costs for raw materials or labor, they typically pass these costs onto consumers in the form of higher prices.

The Impact on Everyday Living Costs

Inflation touches nearly every part of our daily lives. Here are some of the key areas affected:

1. Groceries and Essentials

Perhaps the most noticeable impact of inflation is on the price of groceries. As the cost of raw materials and transportation rises, supermarkets adjust their prices accordingly. Over time, you may find yourself spending significantly more on basic staples like milk, bread, and vegetables.

2. Housing Costs

Inflation can also affect housing prices and rents. When inflation is high, the cost of borrowing money increases, which in turn affects mortgage rates. Additionally, construction costs for new homes also rise, leading to higher prices for both buying and renting property.

3. Energy and Fuel

Energy costs are another significant area where inflation is keenly felt. Rising fuel prices not only impact your cost at the pump but also affect utility bills and the cost of goods that require transportation, ultimately trickling down to the consumer.

4. Healthcare

Healthcare is another sector heavily impacted by inflation. As medical costs rise, so do health insurance premiums. This puts additional strain on family budgets, making it increasingly difficult for many to afford adequate healthcare.

5. Wages

While inflation increases the cost of living, wages don’t always rise at the same rate. This mismatch can lead to a decrease in real income, meaning that even though you may earn more nominally, your actual purchasing power has decreased.

Strategies for Coping with Inflation

Understanding how to manage your finances during inflationary periods is crucial. Here are some strategies to help you cope:

1. Budgeting Wisely

Keeping a close eye on your budget can help you adapt to rising prices. Identify areas where you can cut back and allocate more funds toward essential expenses.

2. Investing

Investing in assets that typically appreciate over time, such as real estate or stocks, can help you hedge against inflation. Be sure to diversify your investment portfolio to minimize risk.

3. Saving

High-interest savings accounts or inflation-protected securities like Treasury Inflation-Protected Securities (TIPS) can offer more stable returns in an inflationary environment.

4. Reducing Debt

High inflation often leads to higher interest rates. If you have outstanding debt, try to pay it down as quickly as possible to avoid paying more in interest over the long term.

The Broader Economic Implications

Inflation doesn’t just impact individual consumers; it also has broader economic implications. High inflation can lead to a decrease in the value of the currency, affecting international trade and investment. Fiscal policies may also shift as governments and central banks adjust strategies to combat inflation, leading to potential changes in tax rates and public spending.

Hyperinflation

While moderate inflation is a normal aspect of a growing economy, hyperinflation is an extreme situation where prices increase uncontrollably. This often results in a collapse of the currency and has devastating effects on the economy. Historical examples include Zimbabwe in the late 2000s and Germany in the 1920s.

Conclusion

Inflation is a multifaceted phenomenon that affects all aspects of daily life, from the cost of groceries to the rate of wage growth. Understanding its causes and impacts can help you better manage your finances and prepare for its effects. By adopting smart financial strategies like budgeting, investing wisely, and reducing debt, you can mitigate the impact of inflation on your everyday living costs.

For more detailed insights on inflation, you can visit Investopedia.

Join the Discussion

How has inflation impacted your daily life? What strategies have you found effective in coping with rising living costs? Share your thoughts and experiences in the comments below!